Investment Theme and Chart Comments from LOTM

Brazil as an Emerging Country and ahead of the USA in getting in front of Inflation.

StoneCo (STNE)* - Fintech Payments Company located in Brazil.

PagSeguro (PAGS)* Fintech Payments Company located in Brazil.

Precious Metal Miners – USD down, Commodities up. Miners are among the first Commodities to react.

Vizsla Silver (VZLA)* -

Lundin Mining (LUNMF)*

Bitcoin & Blockchain, Price actions of Bitcoin is stabilizing. A change in character worth noting.

Grayscale Bitcoin Trust (GBTC)

Osprey Bitcoin Trust (OBTC)

Global Digital (BRPHF)*

Brazil as an Emerging Country and ahead of the USA in getting in front of Inflation.

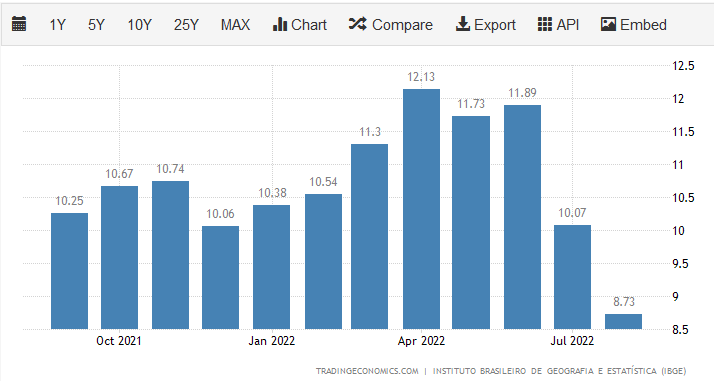

Brazil began raising its interest rates in early 2021 and went from 2% to 13.75%.

Inflation has fallen 28% from April

We are seeing a nice rally in PagSeguro and StoneCo now that Inflation in Brazil is falling. The US Dollar fell away from it highs earlier this week. That also helps international money flows into “Emerging Countries.”

It might be too early to say that the US Dollar has topped, so consider this a preview of what will happen in force “when” the US Dollar declines in a longer-term down trend.

Technically, both PAGS and STNE are in stage one chart patterns. They have now are breaking above their 45-day and 150-day moving averages. A clear buy signal for trend following technical analysts. If the US Dollar rallies, from today’s price, these two stocks will likely drop in price. We consider that a buying opportunity. We have been dollar-cost-averaging and tax loss selling as a way of positioning these two companies. PAGS and STNE are widely followed by institutions in the USA.

Precious Metal Miners – USD down, Commodities up. Miners are among the first Commodities to react.

Are you detecting a trend here? Yes, there is a cause and effect relationship between the US Dollar & Interest Rates on one side of the Teeter Totter and Emerging Markets & Commodities on the other seat of the Teeter Totter. A good fact to keep in mind as we pass through time.

Miners are not as far along as the two Brazilian FinTech’s, but they appear to be bottoming and positioning to rally. When the miners rally and you own them, it is a like touching a bit of heaven. Keep in mind it is tough to stay in heaven for any length of time from this dimension. So, scale out of the metal rally once past a predetermined appreciation threshold.

Two stocks we like a lot, only own one, Vizsla, are Lundin Mining (LUNMF) and Vizsla Silver (VZLA. Vizsla is an exploration company that could challenge as one of the top five silver deposits in the world. Lundin Mining is a low P/E (5.2) and decent dividend (5.2%) producing copper miner. Both are arguably trading below asset values in an inflationary environment. We like them both at the current price. Miners react positively to falling interest rates and falling US Dollar pricing. July low for Vizsla looks solid.

Bitcoin & Blockchain, Price actions of Bitcoin is stabilizing. This is a change in character worth noting. The Blockchain and crypto world went through a debt liquidation phase that (May - June 2022) liquidated any number of companies. The change in character for crypto is now washed out, basing building period that is disconnected from bond and equity action. Historically Blockchain/crypto has had zero correlation to the bond market and 0.15% correlation to the equity market. The decline from $65,000 to below $20,000 was about debt leverage within the crypto/blockchain world. Make no mistake about this. Blockchain will change our world over the next decade. The technology will have a much bigger impact than the internet had on the world in the last two decades. This sell-off is an opportunity for you to buy into Blockchain technology. Out top picks are Galaxy Digital (BRPHF)* and Fintech’s, StoneCo and PagSeguro.

Direct ownership in Bitcoin (BTC) and Ethereum (ETH) on a dollar-cost-averaging basis is suggested. If entering Bitcoin, our top pick if we only bought one crypto, can be done through trusts Grayscale (GBTC) and or Osprey Bitcoin trust (OBTC).

A couple of interesting interviews with Mark Yusko, founder of Morgan Creek Capital and former manager of Duke University’s endowment. I like Yusko in that he pulls no punches on his views of regulation, government attitude and polices.

"The Bear Cycle is OVER" | Mark Yusko Bitcoin 2022" 13 minutes - A very good copy of a presentation Yusko made about a month ago. Does a nice job of explaining what crypto is today as a technology and as well as the investment stage crypto is in.

"Next 12 MONTHS Hold These 4 ASSETS" | Mark Yusko Bitcoin 2022" 12 minutes – pretty stark view of what could unfold in the next twelve months. This should make us think and consider what’s next.

How the blockchain is changing money and business | Don Tapscott – Ted Talk - 18 minutes this was done in 2016. It is interesting to see with hindsight because what was projected in this 2016 presentation is deeply imbedded and happening in the financial community today. This dip in the price of Bitcoin, crypto and Blockchain (now October 2022) is a great opportunity to catch this train that has already left the station, at prices that are attractive.

Written October 6, 2022, by Tom Linzmeier for Tom’s Blog at Substack.com